March 29, 2013

By Jim Cline and Kate Kremer

This is the third article in our eleven-part series reporting on contract settlement trends. This article highlights some of the recent economic developments most likely to impact your negotiations outlook.

Filed Under: Wage Settlements

March 27, 2013

By Jim Cline and Kate Kremer

This is the second article in our eleven-part, Spring 2013 Wage Series. In this article, we take a look at recent contract settlements and examine how those trends vary from recent previous years. Our view of 2012 settlements and what we have so far from 2013, indicates a trend towards rising settlements, but not a full return to the robust, pre Great Recession settlements. Whether a healthy economy will accelerate these trends further, is something we’ll discuss later in this series.

Filed Under: Wage Settlements

March 25, 2013

By Jim Cline and Kate Kremer

This is the first of an eleven-part series addressing current economic conditions and wage settlement trends. In this Spring 2013 Wage Series, we’ll bring you an update on CPI and economic developments, wage settlements, interest arbitration trends, statewide wage rankings for public safety classifications across the State, and an in-depth analysis of what factors appear to be impacting those rankings and settlements.

Filed Under: Wage Settlements

March 22, 2013

By Christopher Casillas

The Washington State Employment Security Department released its monthly employment report for February 2013 today, confirming that a recent trend in new jobs and a drop in the unemployment rate is no mirage, and may be gathering steam. The headline numbers indicate that the State, particularly the Seattle-Bellevue-Everett region, is seeing a strong rebound in new jobs.

Filed Under: Economic Developments, Economics

March 22, 2013

By Christopher Casillas

The State Economic and Revenue Forecast Council released its updated March revenue report and forecast today, showing some improvements in the State’s budget for the current biennium. The revenue forecast for the current biennium has been increased by $58.8 million by the Council. This reports an improvement over the November 2012 forecast, based on an increase in likely tax collections during the current biennium.

Filed Under: Economic Developments, Economics

December 20, 2012

By Jim Cline

The December report of the Washington State Economic and Revenue Forecast Council, contains some mildly good news.

Filed Under: Economic Developments, Economics

December 18, 2012

By Jim Cline

The November national inflation number, as reported by the All Cities CPI-W dropped to 1.7%, a full half percent below the October report for the same Index (2.2%). The All Cities CPI-U was reported at 1.8%. (These indices report inflation as measured over 12 months). According to the Bureau of Labor Statistics report, the drop of inflation is almost entirely attributable to a decrease in gas and energy prices.

Filed Under: CPI, Economic Developments, Economics

November 29, 2012

By Jim Cline and Kate Kremer

We often are asked, what the “Seattle” CPI is and whether it only covers the City of Seattle, or King County. In fact, the “Seattle” index covers the entire Seattle metropolitan area. There is no requirement that you be in, or near “Seattle” to rely upon the Seattle index. In fact, you do not need to be in the Metropolitan area covered by the index, to justify its use. Even Eastern Washington jurisdictions likely have comparables that depend on the Seattle index for inflation adjustments, so tying those contracts into the Seattle index is the surest way to ensure that they keep pace with their Western Washington comparables.

November 28, 2012

By Jim Cline and Kate Kremer

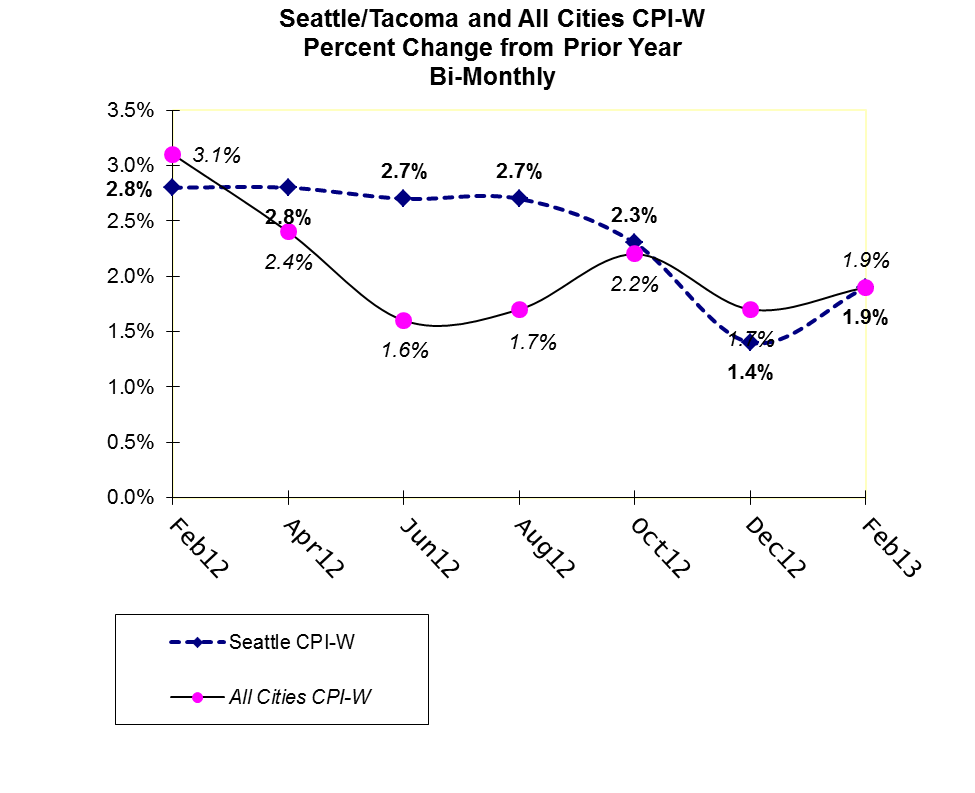

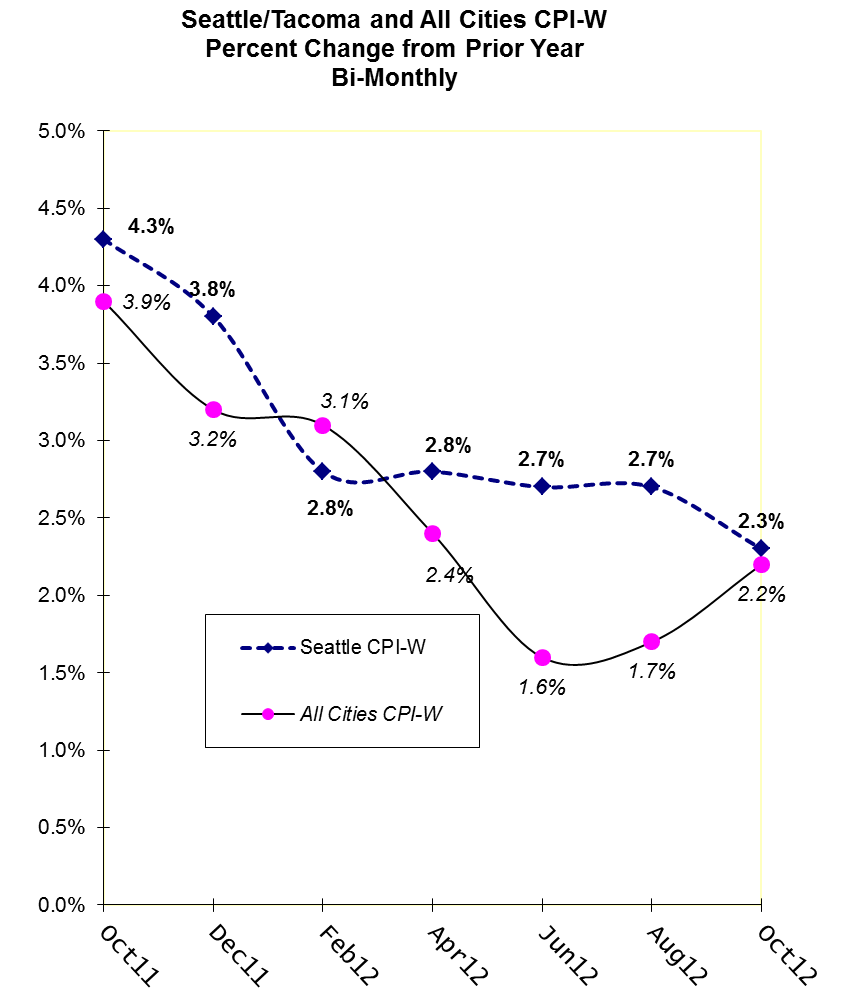

In our last inflation report, the August bimonthly Seattle-W CPI index was a full percentage point above the All Cities-W (2.7% versus 1.7%). However, the latest bimonthly CPI release shows a convergence of the two indices. The October Seattle W has dropped to 2.3% while the All Cities-W has risen to 2.2%:

October 12, 2012

By Jim Cline

The newly-released September 2012 report of the Washington State Economic and Revenue Forecast Council identifies an economy, of a slow national economy coupled with a slightly stronger State economy. This report is consistent with the other recent Forecast Council reports. As we have discussed, the mixed economic conditions impede a full fiscal recovery for the State and local governments and serves as a significant constraint on the current collective bargaining environment. Until government budgets rebuild reserves and the labor market picks up momentum, we are unlikely to return to widespread robust contract settlements.