By Jim Cline

This morning’s monthly All Cities CPI report showed an inflation slowdown. But as it impacts labor negotiations, this development is dwarfed against the larger backdrop of economic and fiscal uncertainty.

This morning’s monthly All Cities CPI report showed an inflation slowdown. But as it impacts labor negotiations, this development is dwarfed against the larger backdrop of economic and fiscal uncertainty.

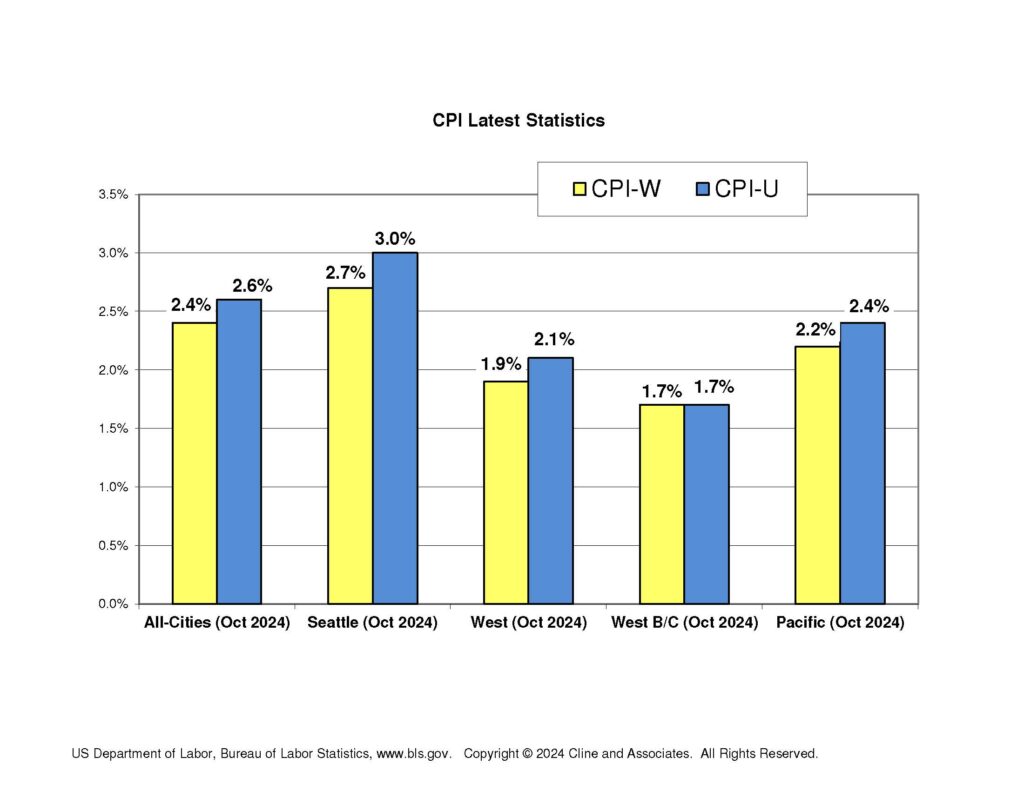

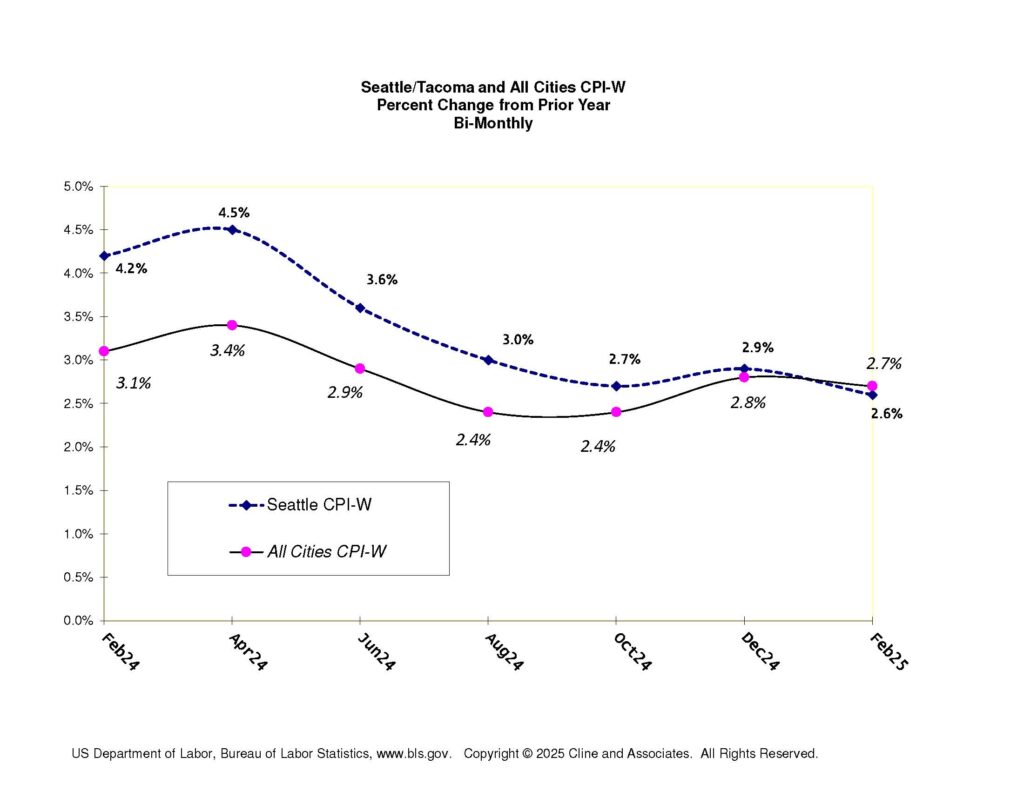

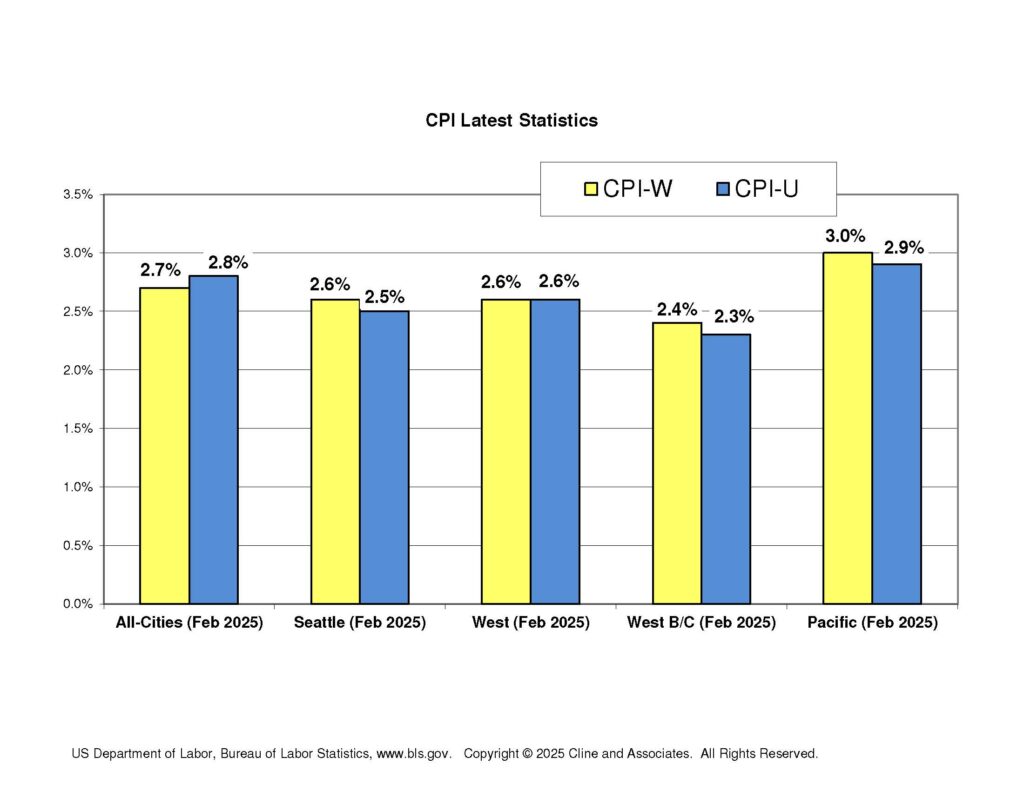

Today the BLS reported the March All Cities CPI at 2.4% for its “U” index and 2.2% for its “W” index. This is significantly down from the February numbers of 2.8% and 2.7%, respectively. The West indices showed similar declines. “The Seattle numbers are reported bi-monthly with the April numbers to be released in mid-May.

This inflation drop exceeded economists’ expectations and would normally point to a reduction in the Fed discount rate, thereby allowing more economic growth. But this inflation news was generally discounted on a day where the stock market continued to fall on fear of the impact of pending tariffs. Economists also noted that the information seemed “stale” as it looked backwards to the end of March and doesn’t account for inflation pressures created by new and potential tariffs. Most tariff threats began after the beginning of April.

What does all this mean for pending and upcoming contract negotiations? There’s great uncertainty coming from different directions which makes any “crystal ball” cloudy at best. These are the three big factors we’re tracking now that would impact negotiations and all of them are very uncertain. These include the recession or economic slowdown risks, the inflation outlook, and the Washington State and local government budget outlook.

National Economy is Uncertain but Recession Risks Rising. The significant drop in the stock market, which continues this morning as I write this, is a concern on its own but more importantly, it’s based on markets anticipating a significant slowdown in the national economy.

At the start of the year, most economists placed the changes of a recession fairly low. The Wall Street Journal panel, reflecting a broad array of economists, placed the risk of a recession this year at 22%. They also predicted a continuation of the current historically low unemployment rates.

The announcement of widespread tariffs, since modified, sent the stock market spinning. It prompted an increase in the number of economists predicting that a recession by year’s end was either probable or highly possible. Day to day predictions varied following the rapidly evolving tariff news. Goldman Sacks, for example, had increased its recession prediction to 65% and then lowered it immediately to 45% upon the announcement of the partial tariff suspension.

The general state of the economy has significant implications for negotiations as it directly impacts local government revenues as well as broader labor market conditions. Even if no recession materializes, it seems most likely that that there will be some significant slowing of the economy.

Future CPI Direction is Uncertain. Despite today’s dip in inflation, most economists have said that any tariffs would increase inflation pressures, possibly adding one or two percent to the existing inflation rate. The Federal Reserve shares this view, leading them to maintain higher interest rates. Almost any current prediction is tied to how widespread new tariffs are. While the Trump Administration announced a 90-day suspension of most tariffs, the tariffs on China are moving forward. And there’s no certainty about what follows this temporary suspension.

Given the relationship between CPI data and year over year contract wage increases, the uncertainty about the direction of inflation complications any negotiations, especially for wages for 2026 and beyond. Many contracts are tied to a specific CPI formula and those that are not at the very least are built upon some assumption of the direction of the cost of living. Most bargaining teams seek to obtain a wage increase that is at least equal, if not greater than, the expected inflation. Where expectations are uncertain, negotiations are more challenging.

State and Local Governments Budgets are Uncertain. The State budget was already looking at painful cuts possibly to be offset by tax increases even before the tariff developments. State government employees were facing furloughs. Any reduction in State spending is likely to have some impact on local governments whose budgets rely on a variety of State funds and grants.

City and county budgets were already facing significant challenges. For the past year or two, sales tax receipts have been fairly flat.

One positive possibility and one not without controversy, is pending legislation to increase property tax revenues. The State Senate and House have pending bills that would modify the existing 1% limit on property tax increases. The bill versions are different, and passage is uncertain but if adopted it would allow some increases above the current 1% cap to be tied to inflation and population growth. The House version retains a 3% limit while the Senate version is only limited by inflation and population growth.

The Tim Eyman initiative that created the existing 1% limit is a significant constraint on local government budgets, especially counties and fire districts that are heavily dependent on property tax revenues. AWC is pressing for this lift and is supported by a broad coalition.

The status of this proposal likely won’t be known until the end of the legislative session. How much this lift will generate even if adopted will still remain uncertain. The legislation would not automatically increase property taxes but would allow local governments to lift their levy up to the maximum under whatever formula may be adopted.

Future developments. We will be keeping a close eye on these and other developments. A clearer picture, whether better or worse, seems likely to emerge in the next few months. We are planning a webcast to discuss these and other issues later this month.

Premium Website Information. For broader information on these developments and data obtain premium website credentials and visit the premium website, Premium website subscriptions include access to Cline and Associates webcasts.

In

In  In our

In our  The Bureau of Labor Statistics released their

The Bureau of Labor Statistics released their

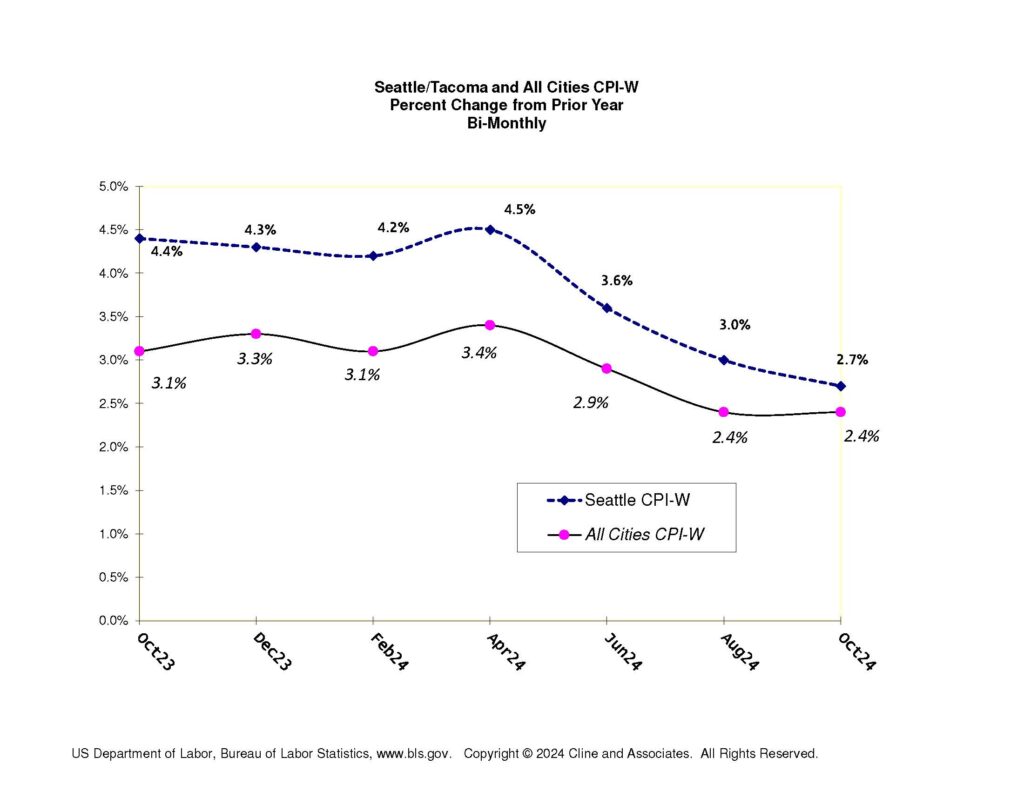

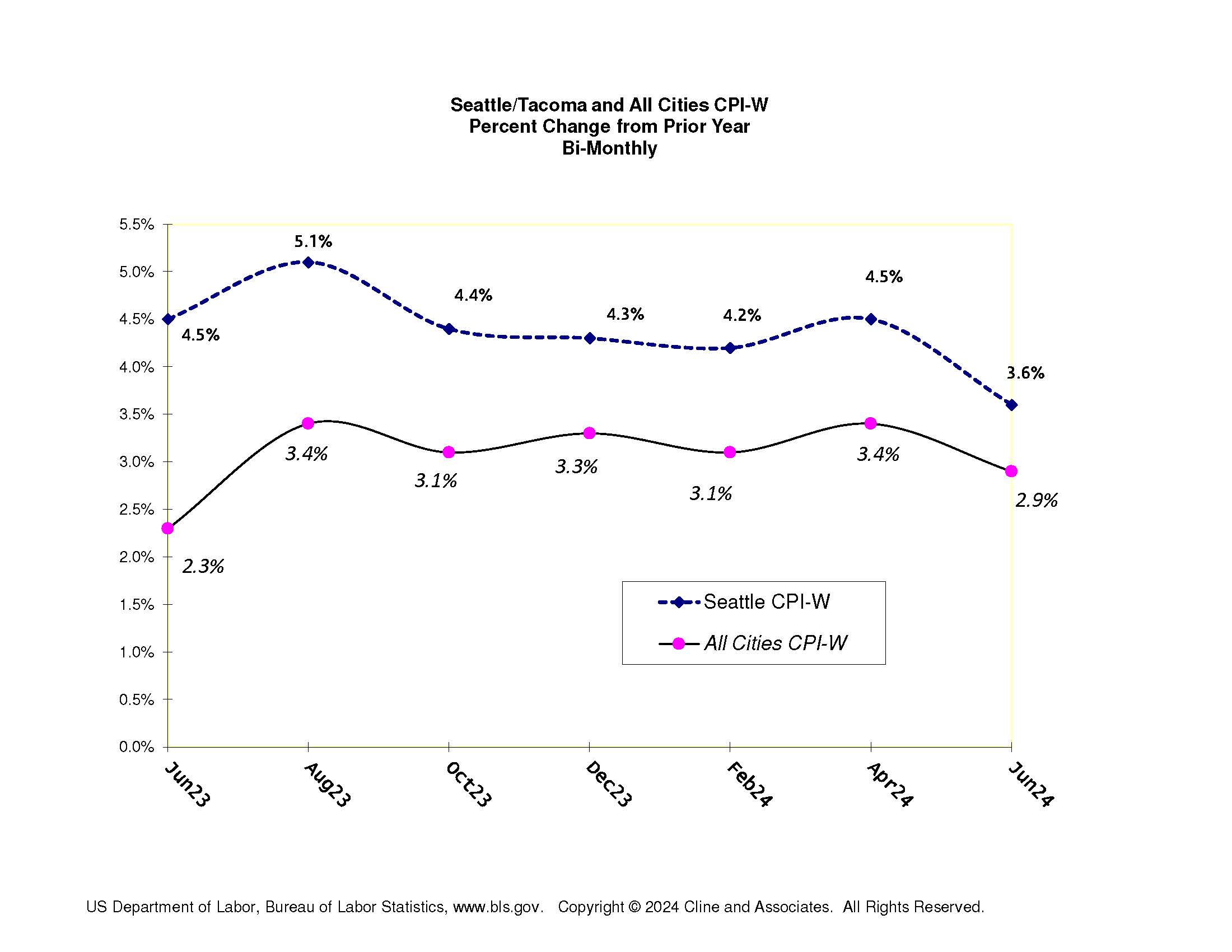

The latest CPI data shows a continued easing in inflation. The period of higher inflation of the past few years seems to be ending at least for now. And the large gap that had existed between the City and All Cities CPI also seems to be closing.

The latest CPI data shows a continued easing in inflation. The period of higher inflation of the past few years seems to be ending at least for now. And the large gap that had existed between the City and All Cities CPI also seems to be closing.