By Jim Cline and Kate Kremer

We have been closely tracking and reporting on inflation trends. The recent “ups and downs” (in inflation has implications for the broader economy but it has some rather direct impacts on our contract negotiations.

We have been closely tracking and reporting on inflation trends. The recent “ups and downs” (in inflation has implications for the broader economy but it has some rather direct impacts on our contract negotiations.

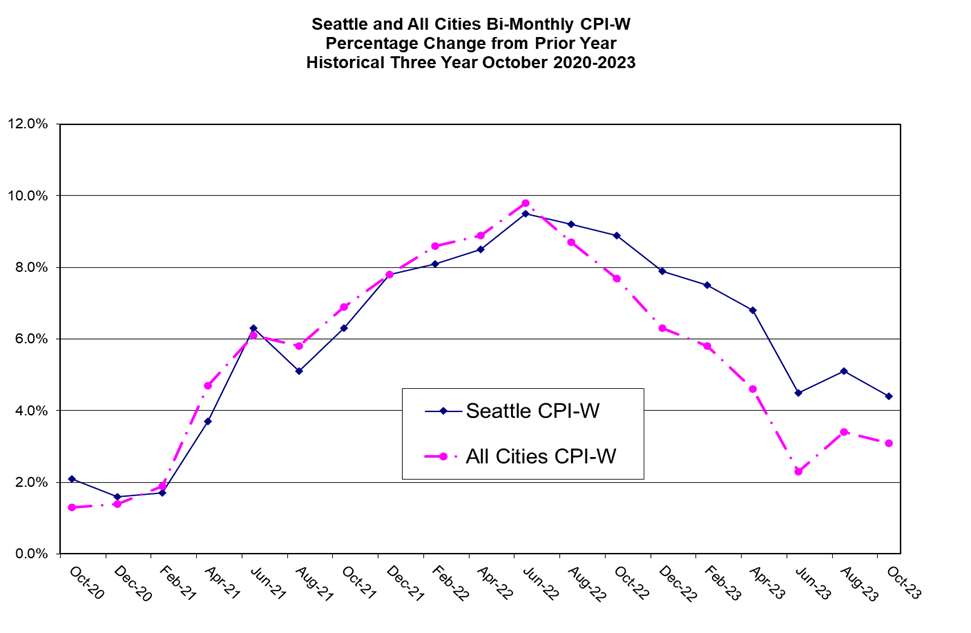

This 3-year chart shows recent ride we’ve been on:

This week we are expecting another update in the All-Cities CPI numbers. Indications exist that suggest the recent drop in inflation will continue and that the All-Cities CPI return to its historic pattern of between 2 to 3% sometime in the next several months.

Another challenging question is how much the Seattle index will fall. For most of the past year, the Seattle index has outpaced the All-Cities index by 1-2%. While it’s common that the Seattle index outpaces the national numbers a bit, the extent of the recent gap has been remarkable and serves as a complicating factor in predicting contract trends – and negotiating those contracts.

We covered many of these issues in our September webcast – Inflation trends have direct and indirect impacts on contracts. Future inflation trends are hard to predict yet reliably anticipating those trends has proven to be a critical factor in successful contract outcomes. Those who missed the 2021 spike lost out, and for some to such an extent they haven’t fully recovered. We’ll be covering this issue.