By Jim Cline and Kate Kremer

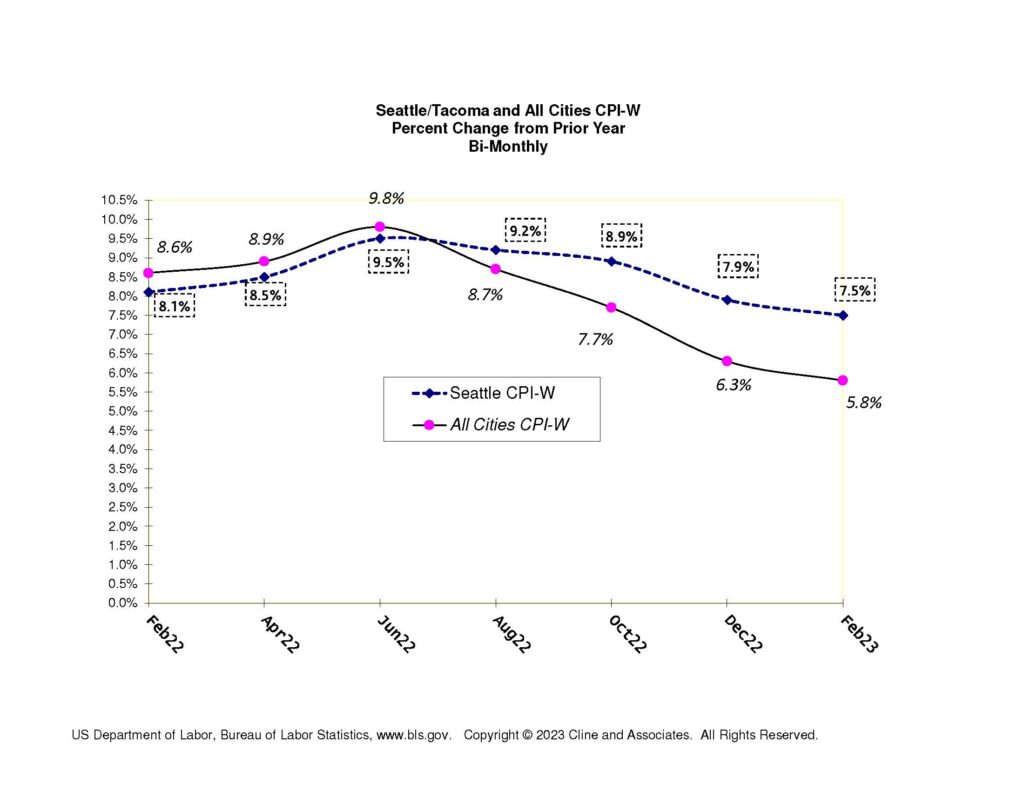

The latest CPI report continued to show high inflation numbers, even higher than the previous set. But inside those numbers were signs that the predicted slowdown in inflation may lie ahead. The Seattle 12-month through April to April “W” index was reported at an eye-popping 8.1%. The All-Cities index was even higher at 8.6%:

The latest CPI report continued to show high inflation numbers, even higher than the previous set. But inside those numbers were signs that the predicted slowdown in inflation may lie ahead. The Seattle 12-month through April to April “W” index was reported at an eye-popping 8.1%. The All-Cities index was even higher at 8.6%:

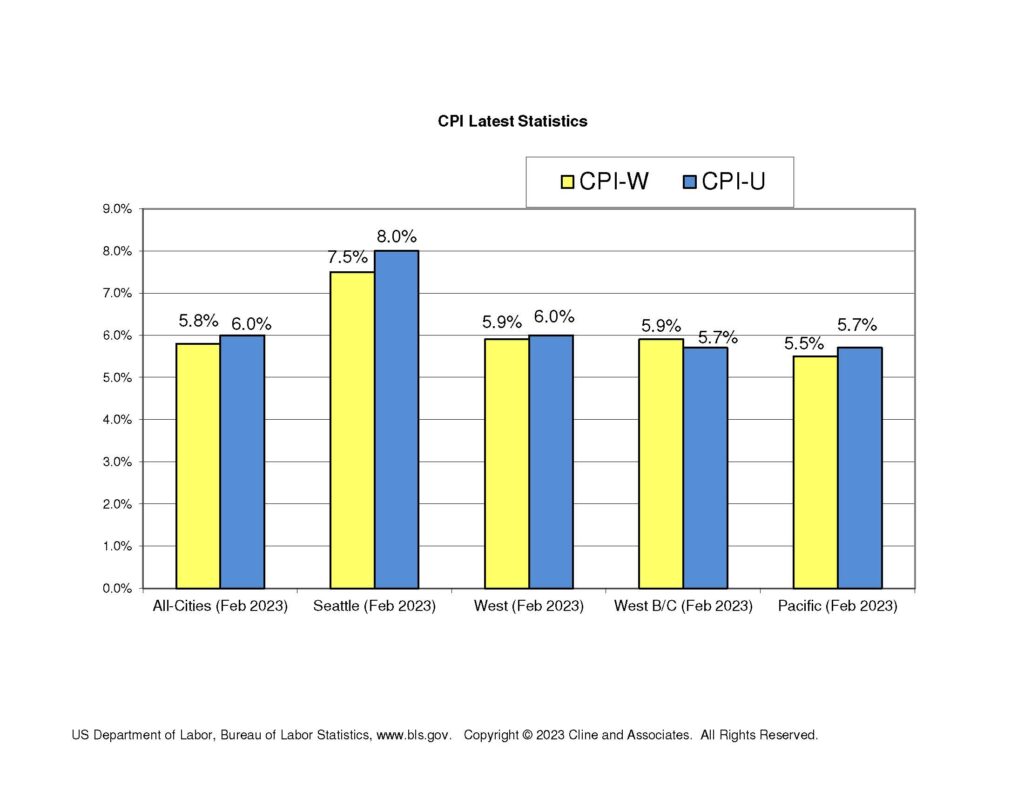

Here’s a chart showing some of the other CPI indices:

Note that the sometimes-used West Coast index reported even higher inflation.

The usually important June CPI report is due within two months (mid-July). What do these trends indicate for the June numbers? We’re expecting the CPI to be lower, likely between 6% to 7%, absent some change of circumstances in the next several weeks. There are two major reasons why we expect that, apart from economists’ predictions of leveling inflation.

First, inside the April report was an indication that inflation may be actually slowing, at least a bit. The national inflation for the month of April subsided to .3%, following a 1.2% rise in March. That rate annualized would be 3.6%. While we’re not expecting CPI to drop below 4% during the next several months, if that trend continues, you’ll get some “bending of the curve.”

Second, the June 12 month number will be calculated on a high baseline. If you review the 12-month lines above, you notice a bit jump between last April and June. That bump in inflation will be the starting point for which this coming June’s number will be calculated. In projecting possible trends in inflation, you have to take a look backward at the prior year’s trendline. If the monthly CPI numbers subside to the .3 or less range, you’ll likely have CPI close to .7%. If they resume their .6% trend, you’ll likely have a June number close to 7%.

Obviously all this higher-than-expected inflation is having a rather dramatic impact on current and future bargaining. How should we expect these data points to impact contract settlements? That will be a topic that we’ll cover in an upcoming newsletter article and webcast. Stay tuned.