By Jim Cline and Kate Kremer

This article continues our series on recent contract settlement trends. It uses city police settlements as the data source, but these trends seem to apply generally to other public safety occupations. In this article we cover the impact of timing (when the contract was settled) on contract settlements.

This article continues our series on recent contract settlement trends. It uses city police settlements as the data source, but these trends seem to apply generally to other public safety occupations. In this article we cover the impact of timing (when the contract was settled) on contract settlements.

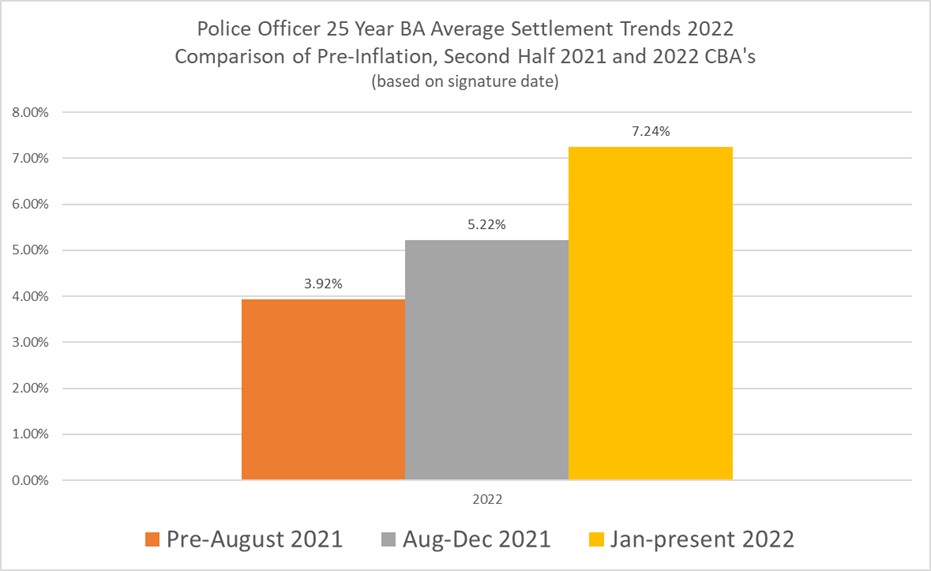

To help illustrate the impact of waiting for inflation to peak, this chart breaks out the 2022 wage settlement trends according to when the labor agreement was signed. All settlements below represent wage settlements for the contract year 2022. The settlements show that contracts signed in the second half of 2021 had higher wage settlements than those settled earlier. And contracts signed in 2022 had even higher wage increases. This makes sense, as the parties to the later signed labor agreements had knowledge of the CPI increases which, as we have stated in earlier articles, were larger than anyone expected.

The pre-August 2021 settlements were entered into without the benefit of the June 2021 inflation numbers. As a result, these settlements averaged 3.92%. By August of 2021, the June CPI was known to parties negotiating wage settlements, with numbers between 5.5% and 6% depending on the index used. As a result, the increasing CPI started to impact settlements and the settlements started to go up. Even in late 2021, there was a belief that the inflation increases would not last. As the CPI numbers continued to rise in 2022, the average settlements rose as well, with average settlements for contracts signed in 2022 coming in at 7.24%. This chart illustrates that waiting can be beneficial at times. However, the opposite could also be true in other cases.

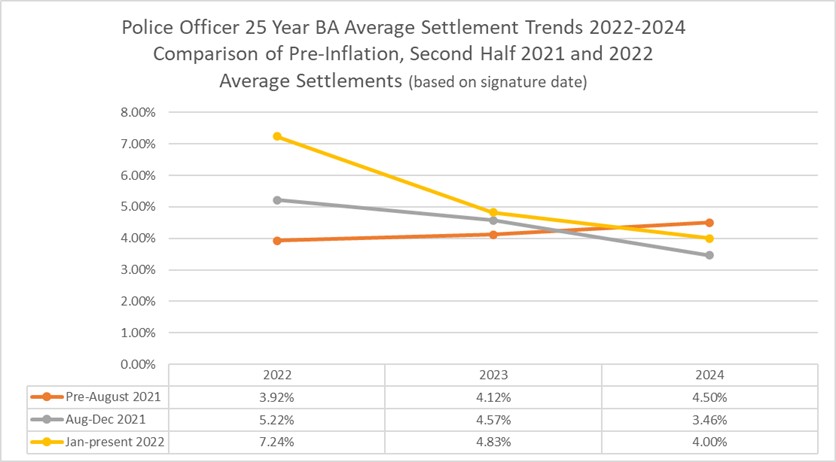

Note that the settlements for 2023 and 2024 are lower than those in 2022. The graph below illustrates this point:

With the CPI still high why is this the case? We see two things holding 2023 and 2024 settlements down. The first is the low number of settlements included in these averages. There is only one pre-August 2021 (before inflation started ramping up) signed contract that included a 2024 specified percentage wage increase. The 4.5% settlement average is not actually an average, it is just one settlement and so not an indication of a trend. As presented in the ”Number of Wage Settlements 2022-2024″ chart, discussed earlier in this article, less than 50% of the Police wages are settled for 2023, and only 11% are settled for 2024. The increasing use of CPI formulas for wages is limiting known 2024 settlements as well, since those are based on 2023 CPI numbers that will not be published until next year.

The second issue impacting the second- and third-year settlements is the increasing use of CPI formula maximums, otherwise known as formula caps. While the first year of the contract often has a percentage increase, second and third year increases often use a CPI formula. The formulas are increasingly using a minimum and maximum percentage that the wage increase cannot fall below or exceed, and the maximum in particular is dampening the impact of the inflation increases and holding back the settlements. Out of 37 settled contracts that use a CPI formula, only five did not have caps.

The lower settlements for 2023 and 2024 seem to have been influenced, in part, by the fact that earlier settlements were reached but many of them have these caps on inflation that didn’t approach the full inflationary numbers.

The lesson here is that the current settlement averages for 2023 and 2024 are not where we’re predicting that the settlements for these years will be once we get a more robust set of settlements. On the other hand, to the extent that a lot of groups are expecting 9 or 10% increases, the average increases for those years will not get that high. The major constraint that we’re facing is the reality that many groups that have already settled for 2023 are not averaging 7, 8, or 9 percent. While we believe that some of the later contract settlements will come in 7 to 9%, that’s not going to bring the averages up that high. We will have to do a deep dive looking at your particular comparables and their settlement trends, but as we look statewide, it does not appear that the average settlements are keeping up with inflation in the short term.

We’ve also learned some strategic lessons applicable to bargaining from periods of high inflation in the past. We believe that these lessons will be helpful to your negotiation team if you’re looking at a two or three-year contract in particular. In the next article in our series, we will discuss these historic lessons from the late ‘70s, which is the last time that inflation has run this high.