By Jim Cline and Kate Kremer

In the last two articles in this series, we discussed recent and projected CPI. We have described the recent spikes in inflation as well as economist predictions that inflation will start to taper off.

In the last two articles in this series, we discussed recent and projected CPI. We have described the recent spikes in inflation as well as economist predictions that inflation will start to taper off.

Depending on what news sources you use or how closely you follow the news, you may have heard some concerns about the possibility of a recession. Economists are starting to claim that the risks are real. And employers are using this as a basis to tamp down wage settlements.

We see this as just another risk factor to consider as you evaluate contract proposals. How real are the risks of recession and how might that impact your position in negotiations? How do you build this into your offers and into your evaluation of the employer’s offers? Do you go forward to arbitration and hope for the best? What are the pros and cons of that?

We think there is some risk of recession. But we think those risks need to be evaluated in context. To be blunt about it, it seems like the possibility there could be a recession is something that employers are weaponizing now in bargaining. Many are using the mere chance of a recession as a justification for some lowball contract offers.

We are not saying that the possibility of a recession isn’t a consideration to factor into your risk assessment on whether to hold out for more or settle. It is. But when you consider the professional opinions of economists both as to the possibility of a recession and its likely form, we believe that recession risks, while real, are a secondary consideration behind other others, such as CPI, comparability, and settlement trends.

While a recession, if one occurs, would have some influence upon arbitrators, there is reason to doubt that it will have a dramatic influence. This is because, at least based upon the projections we’re seeing, any recession will be minor and will not significantly impact the labor market.

We are looking again at the Wall Street Journal panel of economists that we discussed in the previous article on inflation. As we explained then, the economists represent a fair cross section of different views and ideologies.

When the panel was asked about the possibility of a recession during the next 12 months, they were divided on the topic. About half said a recession was likely. But we noted something significant when you closely examine their opinions: almost all that had predicted a recession said that any recession would be mild.

When many of us (and lots of management reps) think of a “recession,” they think back to the events in the years following 2008. That recession was very serious and dramatically impacted government revenues. In turn, it dramatically impacted contract settlements.

But the kind of recession these economists are talking about is nothing like that 2008 recession. In fact, in a lot of ways, it’s a recession that simply meets some of the technical definitions that economists apply but not one that really undermines the labor market and impacts government revenues as the recession following 2008 did.

This becomes clear when you review their predictions for future economic growth as measured by annual “GDP.” We start first with GDP projections the economists are making because those form the point of reference from which they measure a recession.

Most recently, the GDP has been running at about 3 to 4%. Those are solid GDP numbers and an indication of a strong economy with expanding jobs.

The Wall Street Journal economists are predicting that at the end of 2022, the economy will slow down. The average economist was predicting a .71% GDP rate. About a third of the economists were actually predicting a slight contraction of the economy. Some are saying that the economy will continue to grow, perhaps by 2%, which is a healthy rate.

But what we find interesting is that when you look at the GDP projections for 2023, the numbers are slightly higher than the GDP in 2022. In other words, the “recession,” if they’re talking about a recession happening, seems very minor.

It should be noted that the economists’ projections for 2024 forecast economic growth to resume back up to 2%, indicating that any recession that might occur is not expected to last long.

As we have seen, the question of whether a recession might occur is missing a major point. If you’re a Union advocate at the table faced with an employer playing up the threat of a recession, you need to be pressing this counterpoint: The recession that the economists are talking about is simply not like most ordinary recessions.

What do I mean by that? It’s the labor market that we need to consider. The unemployment rate at the current time is, by almost any historic standard, extremely low. There have been discussions among economists about why that is. Does it reflect people leaving the labor market and creating labor shortages? Or is it a symptom of a strong and growing economy? Those questions aside, the reality is that the labor market is extraordinarily tight. This 3.5% unemployment reflects a 50 year low.

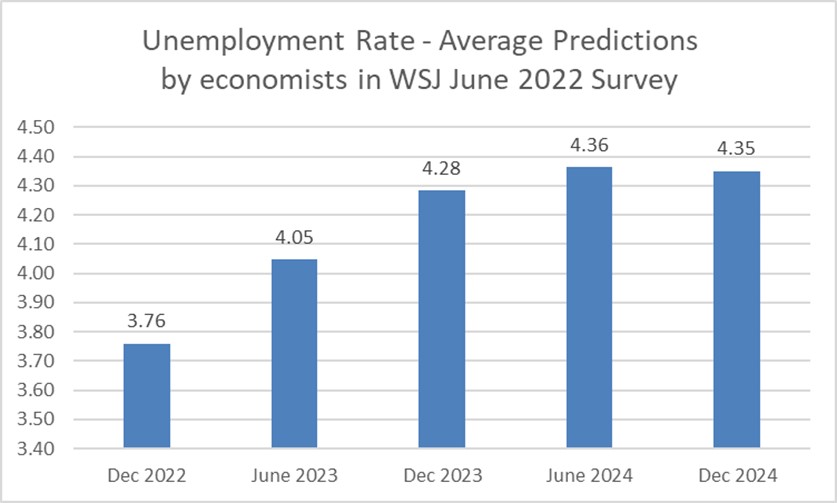

We’ve had healthy economies in the past where the unemployment rate was 5% or even 6%. Not everybody found a job, but the economy was still growing, and wages were still matching or even outpacing inflation under these circumstances. Although some economists are predicting a 50/50 chance of a recession and a slowdown in the GDP, be aware that they are not saying that the labor market will be in a recession. The Wall Street Journal panel of economists have predicted unemployment rates in the range of four to four and a half percent for the next several years. The following numbers are their average unemployment rate predictions: 3.76% at the end of 2022 and just above 4% early 2023, 4.28% in December 2023, and then 4.35% at the end of 2024.

The numbers that we have given you require some perspective. These circumstances are simply something we’ve never seen in the modern U.S. economy before. We’ve never experienced what economists have labeled a “recession” while the labor market was reflecting unemployment in the range of four to four and a half percent.

Why is this important to contract negotiations? Consider this: If you’re an employer and you’re having to “buy” labor in a labor market when the unemployment rate is four to four and a half percent, the fact that your revenues may be slowing down doesn’t change the fact that you are truly facing a very tight labor market. In our estimation, this situation is bound to place an upward pressure on wage rates.

In the next article in this series, we’ll look at how these economic conditions impact the “fiscal” or budget conditions of your employer and how that may impact their posture during negotiations.