By Jim Cline and Kate Kremer

In the last Newsletter article in this series, we updated you on recent inflation numbers. This included a surprisingly large jump in the inflation reported in June, followed by a modest decline in July. Do the July numbers indicate that we’ve turned a corner? If so, how far can we expect the CPI to drop? That’s the topic that we turn to today.

In the last Newsletter article in this series, we updated you on recent inflation numbers. This included a surprisingly large jump in the inflation reported in June, followed by a modest decline in July. Do the July numbers indicate that we’ve turned a corner? If so, how far can we expect the CPI to drop? That’s the topic that we turn to today.

One of the key factors that we look at to get a sense of the direction of inflation (and other economic indicators) is the opinion of professional economists. The best resource we’ve found is a quarterly survey that’s performed by the Wall Street Journal. We believe that this resource provides as close to a solid consensus opinion as you can have about the direction of inflation and other important economic measures.

The Wall Street Journal has assembled a diverse panel of over 50 economists that strike a balance between those that are liberal and conservative, Democrat and Republican, those that work for banks or corporations, and academic economists that work for universities. In other words, the Wall Street Journal report represents a good a cross-section of opinions that minimizes the impact of political or ideological motivations.

If you are following the mass media or cable networks, you’re going to get different reports on the direction of the economy or the direction of inflation. And we give limited credence to one-off reports by various cable channels typically reflect the political slant that that particular cable channel adopts. We don’t provide advice to our clients based on politics. We rely on a neutral view of the evidence. Additionally, we especially don’t recommend our clients make long-term bargaining decisions based on news channel reporting when those outlets might be serving a political function. We use a panel like the one surveyed by the Wall Street Journal that represents a broader consensus of economists.

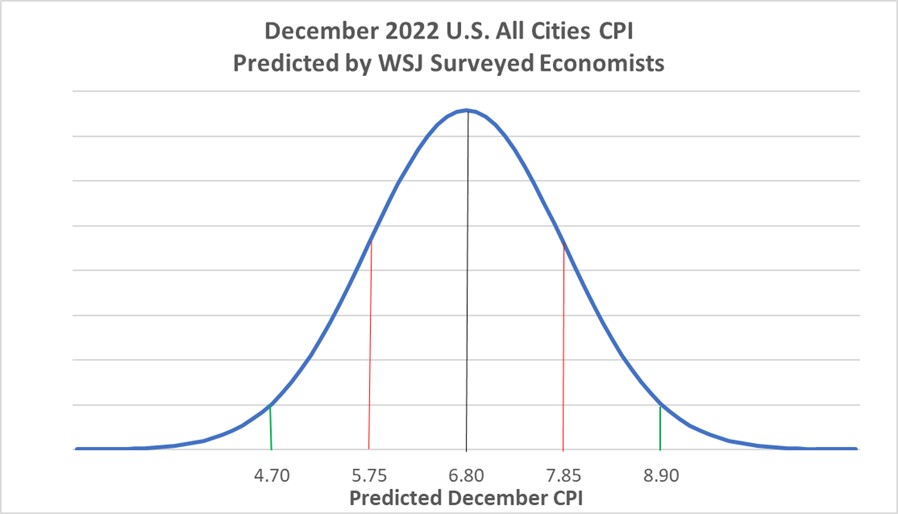

So, what do economists say about the direction of inflation and the economy? Here’s a bell-shaped curve compiling the different predictions economists have made for where 2022 will end up:

Their average projection was that by December of this year, the inflation rate will slow down to 6.8%. Two-thirds of the economists surveyed said that by the end of the year, the CPI would be somewhere between 5.75% and 7.85%. And 90% of the economists said that the inflation rate would be between 4.7% and 8.9%.

So, there may be some economists who say that the inflation rate will drop to 3% or others who say it will still be above 10% (or even higher.) But these views don’t represent the mainstream view of professional economists. And we think you should be considering mainstream cross-section view if you’re doing a business-like risk benefit assessment in your decision-making during negotiations.

This becomes even more important as you look towards negotiating wage increases for 2024 and beyond. We already know the June 2022 CPI, which would be the primary “driver” for 2023 settlements. But how do you evaluate employer proposals for 2024 when CPI is uncertain?

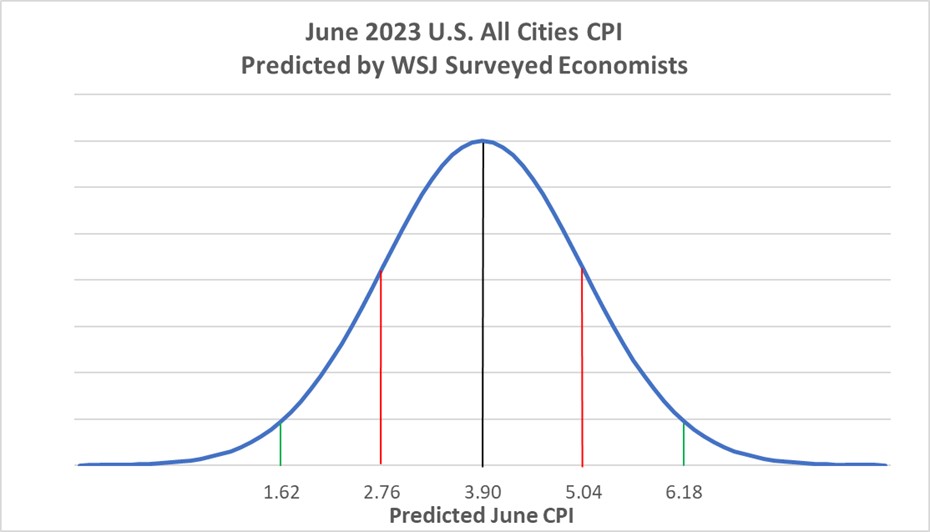

What we see as we move into 2023 is that economists are predicting a dramatic slowdown of inflation. The average prediction for inflation from these economists is a slowdown to 3.9%.

67% of the economists predict that inflation will fall to somewhere between 2.76% and 5.04%. And 90% of the economists said it would fall to somewhere between 1.62% and 6.18%. So, the expectation most economists share is that by next June, we’re not going to have 7, 8, or 9 percent inflation like we’re seeing right now. They are predicting a significant slowdown. Note that they are not predicting that inflation will drop back to its more recent historic 2% to 3%, but certainly lower than it has been over the past two years.

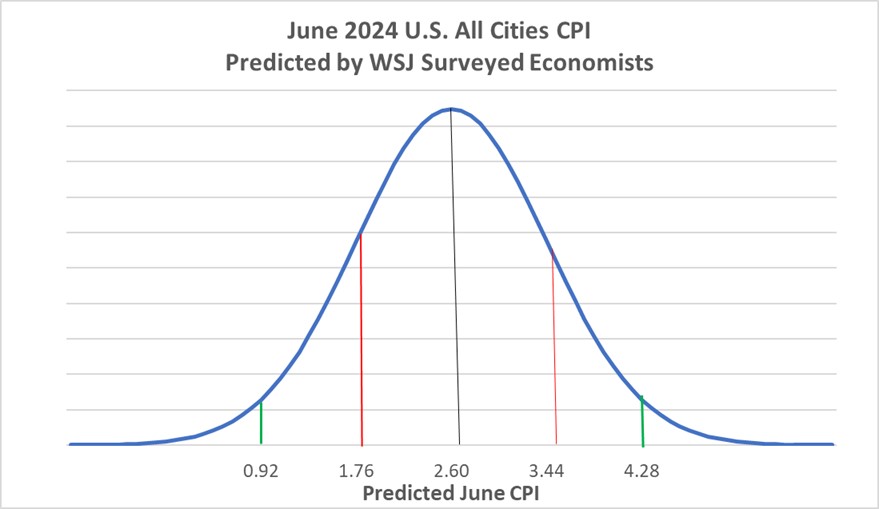

As we look forward to 2024, these economists are predicting a further slowdown with CPI numbers closer to the historic norms. The panel is predicting CPI around 2 to 3%, with the average prediction of economics by June of 2024 being 2.6%.

As you can see here, very few economists are predicting future inflation higher than 4%.

How is that relevant for negotiations? If you’re going into bargaining now and anticipate negotiating a contract to cover 2023, 2024, possibly 2025, you want to be thinking about what the CPI may look like in those years. You would also want to consider how these developments may affect the settlements of your comparables to ensure that you do not negotiate a contract that will put you behind.

You or your members don’t need to be trained economists to understand how inflation affects your paycheck. Economists use a concept called “real wages” to explain the impact of inflation. If inflation goes up 10%, but you don’t get any raise, you’ve effectively had a reduction of your “real wage” of 10%. Although inflation has gone up 10%, your wages have stayed stagnant. So that’s virtually the same as having a 10% pay cut.

You’ve probably dealt with this as you have interacted with your membership during bargaining. As you bargain wages, they are making you very aware that if, for example, inflation is running 5% and they only get a 5% raise, it feels like they’re not even getting a raise.

But CPI is only one of many factors to consider. In future articles in this series, we’re going to discuss the overall direction of the economy, the labor market, and what we’re expecting to see in contract settlements.