By Jim Cline and Kate Kremer

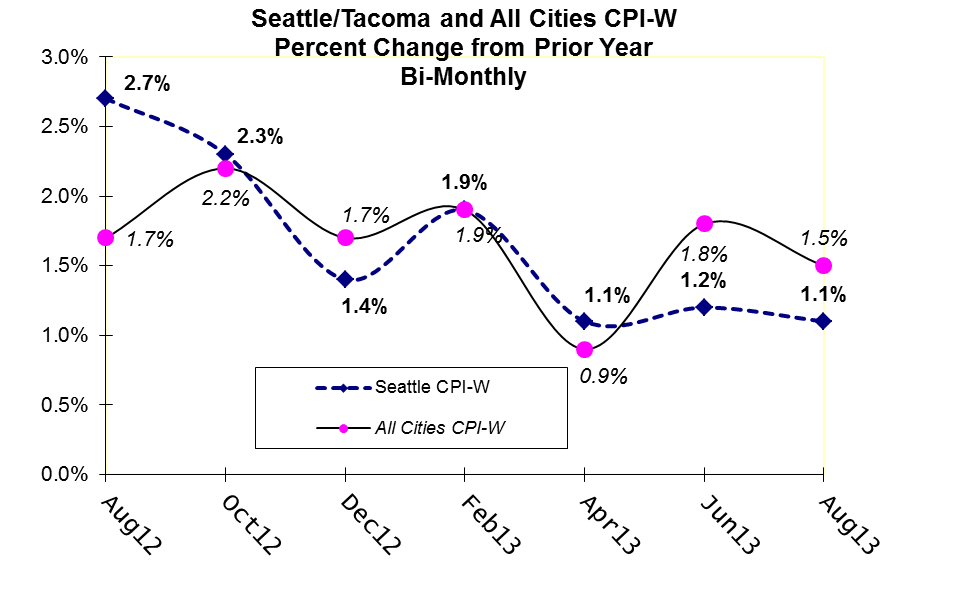

As we had suggested in our last article on inflation trends, inflation seems to be trending downward. The CPI numbers confirm that trend. The latest inflation report both for Seattle and All-Cities is sub-2% and other recent inflation projections suggest that trend might continue. The recently released August CPI numbers report the National inflation index (All-Cities-W) at 1.5% and the Seattle-W even lower — 1.1%. A year ago, the corresponding were 1.7% (All-Cities) and 2.7% (Seattle): This graph shows the declining rate over the past year:

As we had suggested in our last article on inflation trends, inflation seems to be trending downward. The CPI numbers confirm that trend. The latest inflation report both for Seattle and All-Cities is sub-2% and other recent inflation projections suggest that trend might continue. The recently released August CPI numbers report the National inflation index (All-Cities-W) at 1.5% and the Seattle-W even lower — 1.1%. A year ago, the corresponding were 1.7% (All-Cities) and 2.7% (Seattle): This graph shows the declining rate over the past year:

In our last CPI article we explained:

Historically, over the past 20 years, inflation is around 3%. More recently, 2% inflation seems to reflect the “new normal.” Most recent economic forecasts predict 2% inflation in the next two to three years.

But now, even those projections are in further doubt. The latest revised projections of the Federal Reserve have been reduced below 2% in the near term with inflation likely to stay below 2% until 2015 or 2016. The Fed is predicting inflation for the year 2013, will be between 1.1% to 1.5%, rising to an expected “range” of 1.5% to 2% for 2014.

In a recent policy statement, the Federal Reserve Bank indicated, yet again, that its policy “target” is for 2% inflation. It stated that “recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, but it anticipates that inflation will move back toward its objective over the medium term.”

These Fed statements are reminders that the current sub-2% inflation will not continue indefinitely. The Fed target “misses” likely arise from the Fed’s underestimation of the amount of economic growth and inflation pressures associated with that during the current modest recovery. In other words, they had predicted more growth, that didn’t materialize and now inflation has slowed further. The Fed has virtually admitted as much, with Fed Chairman Benacke suggesting they had been “over optimistic” about growth that didn’t’ occur.

But these Fed statements also serve as another reminder that the “old normal” inflation rate of 3% won’t likely return in the near future unless the economy significantly heats up or the Federal Reserve Bank adjusts its inflation target. Some economists have argued that the Fed should adopt a policy permitting a higher rate of inflation to allow more economic growth. This, of course, has collective bargaining implications. To the extent that inflation drives some contract settlements and to the extent that those settlements drive others, it seem rather improbable that we’ll witness a return to the “old normal” contract settlements in the neighborhood of 3%.

But, does that mean Washington public safety labor settlements in 2014 will be submerged below 2%? We find that unlikely. As we said two months ago, and still hold to:

Despite the low [June] Seattle CPI 1.2% number, we think other developments will be pushing settlements near or above 2%. Recent economic growth and rebounding sales tax revenues, something we’ll write about in our next economic blog article, cause us to be more optimistic about settlement trends than we have been since the 2008 start of the recession. Improving fiscal conditions not only increase available settlement funds, it will also likely lead to a resumption of hiring which, in turn, will start to press employers to offer and maintain a more competitive wage posture than they were required to do during recent hiring freeze periods.

Labor market pressures that could drive wages, undoubtedly, will be occupation and region specific. We especially see that the Seattle area economy is growing faster at this time than those in most rural Washington regions. We see anecdotal reports of modest recruitment and retention pressures at this time, but we are expecting those pressures to increase in 2014. We are witnessing widespread indications from City and County budget officers that their reserves are replenished and Cities and Counties appear to be preparing to increase public safety staffing in the 2014 budgets. Depending on how those staffing proposals fair in the 2014 budget planning process, we could see a mini-surge of hiring next year. Depending on the extent of that surge and the extent to which an aging LEOFF II cohort retires, sufficient labor market pressures may arise by mid-2014 that would force some agencies to raise their salaries.

We will provide an update on 2013 settlements soon, and then revisit what might be anticipated for 2014. In any event, while the low inflation reports likely suggest some downward pressure on settlement trends, other contra indicators suggest that settlements will, as we previously predicted, be “near or above 2%.” That’s our “best educated” guess right now and time will tell how well we hit our own target.